MYTHBUSTERS: Investing In Renewable Energy In New Zealand - A Transformative Investment Opportunity

By Simon Currie

Aotearoa New Zealand offers some of the most exciting and immediate renewable energy investment opportunities globally.

In this insight Simon Currie, Executive Chair of Kākāriki Renewables, busts 10 myths which are raised when investors and commentators are looking at renewable energy opportunities in New Zealand.

#1 New Zealand is too small to host GWs of new renewable energy projects

New Zealand has a small population, but it is not a small country. At over 268,000 km² it is larger than the United Kingdom, over 70% of the size of Japan and over half the size of Spain – and no one ever calls those countries small.

To put things in context New Zealand currently has around 1.8m hectares in dairy production and 1.7m hectares in exotic plantation forests. To meet NZ’s current peak electricity demand of over 7GW from solar generation alone (on a sunny day) would require only around 15,000 hectares.

#2 NZ has an 88% renewable grid already – the risk of a stranded investment is too high

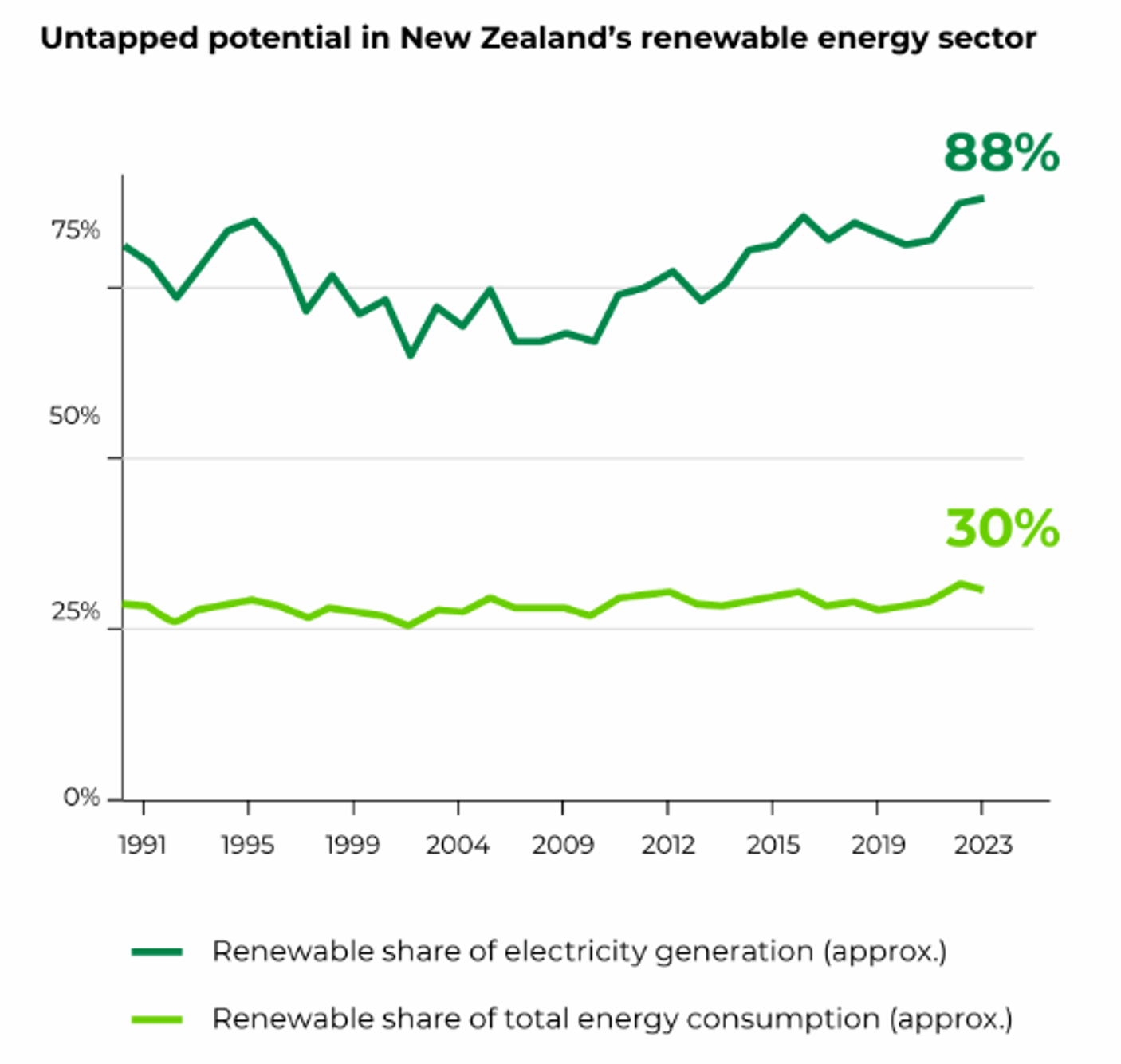

Renewable energy did account for ~88% of New Zealand’s electricity generation in 2023 and ~87% in 2024, driven by enhanced contributions from hydro, wind and solar power.

But electricity generation is only a part of NZ’s overall energy demand. Just 30% of NZ’s total current energy use is powered by renewable energy, when you consider industrial processes and transportation. The remaining 70% is dependent on fossil fuels including coal, natural gas and gasoline.

The majority of these fuels are imported with New Zealand at the end of a long supply chain. This creates a significant opportunity to enhance energy security and reduce New Zealand’s emissions by expanding renewable energy use across all sectors, particularly by electrifying industrial processes and transitioning vehicle fleets to low carbon vehicles. This opportunity is amplified by New Zealand’s ability to export renewable energy through food, metals, fuels and data. Renewable energy’s share of electricity generation and total energy consumption is shown below in a graph produced by InvestNZ for their Renewable Energy Investment Prospectus published in 2025.

#3 Subsidies for renewables could be removed by governments in the future

NO – renewable energy in New Zealand is completely unsubsidised and never has been. Wind, solar and batteries have to compete head-to-head with other forms of electricity generations such as geothermal, hydro, coal and gas. So, there is no risk that a future government can remove subsidies.

The current government has introduced reforms to the consenting regime to accelerate the pathway for renewable energy and infrastructure generally. This is all about reducing barriers to investment rather than introducing subsidies.

#4 Isn’t solar already causing a duck curve in power prices?

Duck curves are now common in many power markets globally, however, NZ currently has one of the lowest penetration of rooftop solar in the OECD. In 2024, grid-connected solar power generated 601 gigawatt-hours (GWh) of electricity in New Zealand, accounting for approximately 1.4% of the country's total electricity generation.

Things are starting to pick up thanks to good work from groups like Rewiring Aotearoa. There is a growing pipeline of solar projects with around 792 MW of grid-connected solar capacity installed as of September 2025, however when peak demand is currently over 7GW and demand is increasing there is a long way to go.

#5 Doesn’t New Zealand have an energy crisis?

The electricity market in New Zealand has been volatile over recent years, like many other markets globally largely due to the impacts of the invasion of Ukraine by Russia. The situation in New Zealand is exacerbated by the dry year risk (when inflows to the South Island hydro lakes are low) and rapidly declining gas reserves and production. In recent years this has led to power prices being higher than historic trends and energy intensive industries have reduced their demand and, in some case, have been forced to close.

New Zealand is facing energy security and affordability challenges from declining gas reserves and production. This creates immediate and long-term opportunities for more renewable energy generation and storage projects to support accelerated electrification of industry and communities. So, it is less of a crisis and more of an opportunity to diversify energy supply options for existing and new energy users.

This Act requires councils to facilitate Māori participation in decision-making.

#6 No new hydro or geothermal projects can be built

New Zealand is blessed with hydropower and geothermal resources and has already tapped significant resources – with over 5GW of hydro capacity and 1GW of geothermal capacity.

Developing new large scale hydropower projects is challenging due to the actual and perceived environmental impacts but some smaller schemes are in development including a 60MW scheme in the West Coast. NZ has many opportunities to develop pumped hydro energy storage projects. Recently a private consortium announced that it is developing the Onslow “NZ Battery” mega-pumped hydro project in the South Island – which was originally proposed by the last Government as an option to mitigate dry year risk.

New Zealand has considerable untapped geothermal resources, and the Government recently announced a draft strategy to double capacity by 2040.

#7 NZ has high tax rates which don’t incentivise investments

In 2024 New Zealand was ranked 3rd globally in the developed world by the International Tax Competitiveness Index. NZ’s corporate tax rate is 28% and the highest income tax rate is 39%, which is lower than Australia in both cases. From the perspective of an investor in renewable energy New Zealand’s tax system has some attractive features:

No capital gains tax - No stamp duty - No land tax or equivalent

This makes it easier to develop projects and bring in investors through the development cycle compared with other jurisdictions where such investments can incur material costs due to such imposts.

#8 There are no big energy users in New Zealand

New Zealand is an export-oriented economy which has traditionally supported energy intensive industries. The largest power consumer is Rio Tinto’s Tiwai aluminium smelter at the bottom of the South Island which produces some of the world’s highest purity aluminium and has a maximum demand of 570MW. The alumina exported to Tiwai Point from Gladstone in Queensland is the largest single export from Australia to NZ. In June 2024 Rio Tinto extended the life of the smelter for 20 years, to be supported by investment in new renewable energy generation.

New Zealand supplies ~30% of the traded dairy products globally and these are produced at plants dotted across the country. The energy used by the dairy industry is a mixture of electricity, coal and natural gas with diesel for milk tankers. Faced with NZ’s dwindling gas supplies the dairy industry is accelerating electrification which will push up power demand in New Zealand materially.

NZ Steel, part of the Bluescope Group, just switched on its first stage electric arc furnace at its Glenbrook steel plant and currently uses significant amounts of natural gas in its cold rolling mill. The NZ Government also recently announced that it would be looking to enter into power purchase arrangements with renewable energy generators to meet the load requirements across different Government departments.

Data centres are a growing source of demand in New Zealand. New Zealand has the potential to become a regional and global hub for data centre campuses (which may be better described as AI factories). Multiple subsea data cables connect New Zealand to regional and global markets with more to come AWS reconfirmed its data centre plans for New Zealand in September 2025 and other key players such as CDC and DataGrid have plans to develop data centres which in aggregate would result in GWs of new demand. New energy intensive industries such as manufacturing of new value products (like sustainable building materials and food processing) and renewable fuels are also driving demand for more electricity into the future.

#9 New Zealand lacks capacity to build projects

New Zealand has a track record of delivering large scale projects from tunnels to subsea HVDC cables to world scale geothermal plants. There is a robust and diversified local contracting base and increasing investment by regional and global construction and delivery companies such as Acciona, VINCI, Hyundai, BEON, Metka and Elecnor. Global leaders like Nextpower, SMA Solar and Vestas are currently delivering large scale renewable projects across the country.

There is strong support from the NZ Government and key agencies like InvestNZ to attract new entrants into the construction and delivery. New Zealand is well known for its nimble and skilled workforce – just ask Australian businesses who regularly poach New Zealand talent to help build major projects.

#10 There are no credible local partners in New Zealand

Māori partnerships in the energy sector are growing rapidly, focusing on major renewable projects (solar, geothermal, hydro) driven by the principles of kaitiakitanga (guardianship) and economic self-determination, with iwi and Māori entities taking significant equity stakes, leading development, and securing benefits like jobs, training, and supply chain roles, marking a shift from historical marginalization to co-ownership and leadership in Aotearoa's green energy future. A recent example is Tōtara Energy LP, a Māori-led consortium, acquiring a 30% stake in Pioneer Energy Group.

New Zealand also has a broad mix of companies who can and are willing to partner with new investors into the energy sector, ranging from the four gentailers (Mercury, Meridian, Genesis and Contact) to independent generators like Lodestone, Helios and Harmony. Clarus, the local gas infrastructure company, has just been broken up with Brookfield acquiring the bulk of the business including the renewables arm. The electricity distribution sector is ready and waiting for partnerships and the high number of regional electricity utilities (called EDBs) in New Zealand (29) means that there are lots of potential partners who have hands-on experience in the electricity sector.

Our company, Kākāriki Renewables, is built on partnerships.

We would be delighted to talk to anyone who is interested in partnering with us in New Zealand, and to help drive this transformative investment opportunity.

info@kakarikirenewables.com

www.kakarikirenewables.com